Which Is Right For You?

What We Offer?

At RWright Consulting Services, we offer a range of services designed to protect what matters most to you. Our goal is to provide peace of mind through personalized coverage solutions that fit your unique needs.

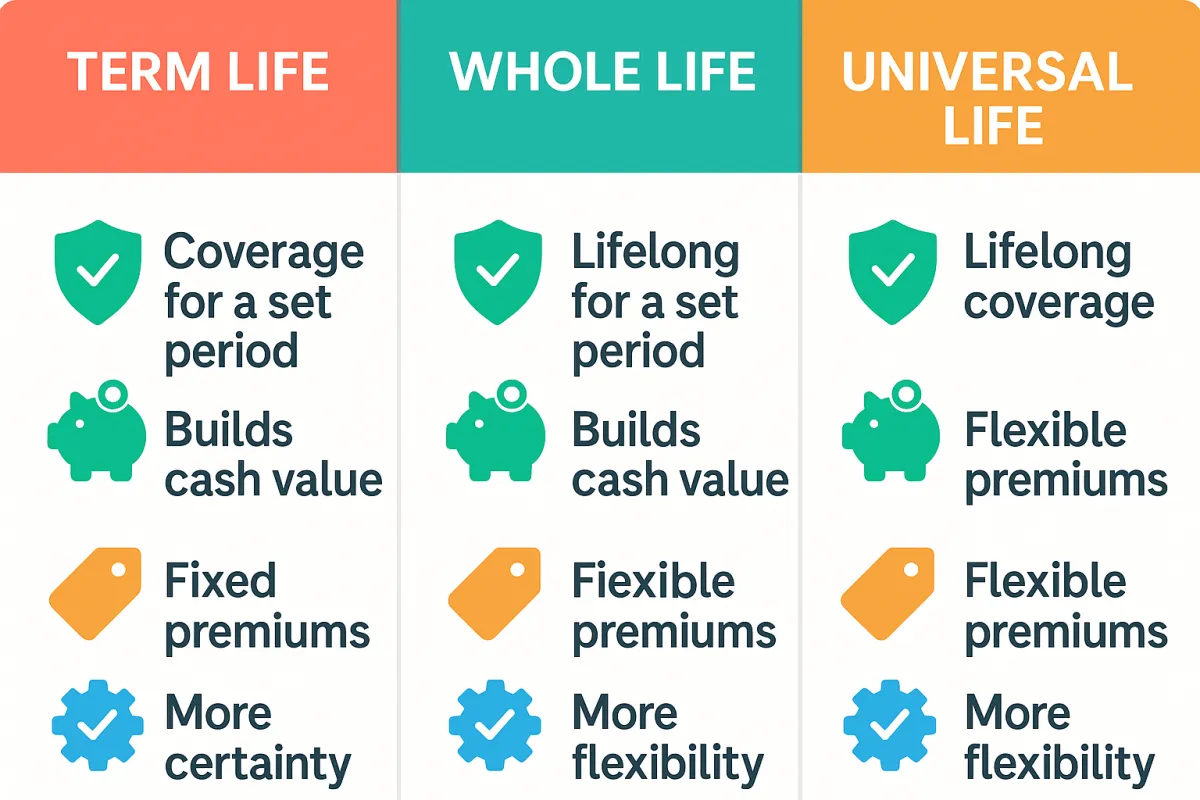

Term Life

Affordable coverage for a set period, ideal for temporary financial protection needs.

Whole Life

Lifelong protection with cash value growth, ensuring peace of mind and stability.

Universal Life

Flexible coverage with investment potential, adapting to your changing financial goals

.

Final Expense

Final Expense is a small policy meant to cover your funeral, burial, or other final bills.

pre-need

Pre-Need is a policy you buy directly through a funeral home. Locks in today’s prices and pays them directly when the time

comes.

mortgage insurance

Mortgage protection is a life insurance policy designed specifically to help

pay off your mortgage

if you pass away unexpectedly

Let's make it less complicated and see what's right for you.

What Is Term Life Insurance (In Simple Terms)?

Term life insurance is a simple, affordable way to protect your loved ones financially if something happens to you. You choose how long the coverage lasts—typically 10, 20, or 30 years—and during that time, if you pass away, your family gets a lump sum of money (called a death benefit).

It’s like a safety net: you pay a small monthly amount to make sure your family can cover things like rent or mortgage, bills, or even college tuition if you’re no longer around.

Why It Matters:

It’s usually very affordable, especially when you’re younger and healthy. It gives peace of mind—knowing your family won’t be left struggling. When the term ends, you can renew it, let it expire, or switch to another policy.

Think of it as protecting your family's future during the years they would need your income the most.

What Is Whole Life Insurance (In Simple Terms)?

Whole life insurance is a type of life insurance that lasts your entire life—no matter how long you live. As long as you keep paying your premiums, your loved ones are guaranteed a payout (called a death benefit) when you pass away.

But here’s what makes it different: Whole life also

builds cash value over time. That means part of the money you pay each month goes into a savings-like account that grows over the years. You can even borrow from it if you need to while you’re still alive.

So, it’s like getting two things in one: A lifelong safety net for your family. A financial tool you can use while you’re living.

Why It Matters:

It lasts forever—no expiration date like term life. Builds cash value you can use for emergencies, loans, or extra income🧾 Monthly payments are higher than term life, but they never go up.

Think of it as lifetime protection plus a built-in savings plan that grows with you.

What Is Universal Life Insurance?

Universal Life Insurance is a flexible type of permanent life insurance. That means it covers you for your entire life,

as long as you keep the policy active — but with more control and customization than whole life.

The key difference? You get to adjust your premiums

and death benefit over time. Plus, part of your payment goes into a cash value account that grows over time — and you can borrow from it or use it to help pay premiums later.

Why People Like It:

Flexibility: You can increase or decrease your monthly payments (within limits), which can help when your budget changes. Cash Value Growth: Some of your money earns interest, giving you a financial cushion you can use later in life.Lifelong Protection: As long as the policy stays funded, your loved ones are covered.

Long-Term Impact:

Universal Life can be part of a bigger financial strategy — helping you protect your family , build tax-advantaged savings , and even access funds for emergencies or retirement.

Final Expense

Final expense insurance is a small whole life policy meant to cover end-of-life costs—like funeral services, burial, and medical bills. It's usually easier to qualify for and has lower coverage amounts (like $5,000–$25,000), but it gives your family peace of mind knowing those final bills are taken care of.

Why it matters:

✅ Helps loved ones avoid financial stress during a hard time

✅ No medical exam in many cases

✅ Affordable and easy to get, even later in life

Final Expense

Final expense insurance is a small whole life policy meant to cover end-of-life costs—like funeral services, burial, and medical bills. It's usually easier to qualify for and has lower coverage amounts (like $5,000–$25,000), but it gives your family peace of mind knowing those final bills are taken care of.

Why it matters:

✅ Helps loved ones avoid financial stress during a hard time

✅ No medical exam in many cases

✅ Affordable and easy to get, even later in life

Pre-Need Insurance

Pre-need insurance is tied directly to a funeral home and pays for your funeral

in advance at today’s prices. You sit down and choose everything—from the casket to the flowers—and the insurance pays the funeral home directly when you pass away.

Why it matters:

✅ Locks in funeral costs now (before prices go up)

✅ Guarantees your wishes are followed

✅ Eases planning pressure for your family

Mortgage Insurance

Mortgage protection insurance (MPI) helps pay off your mortgage if you pass away—so your loved ones can stay in the home without worrying about the monthly payments. It’s a type of term life policy, and the benefit amount usually matches your mortgage balance.

Why it matters:

✅ Keeps your family in the home

✅ Pays directly to the lender (or sometimes to your family)

✅ Often easier to qualify for than traditional life insurance

Mortgage Insurance

Mortgage protection insurance (MPI) helps pay off your mortgage if you pass away—so your loved ones can stay in the home without worrying about the monthly payments. It’s a type of term life policy, and the benefit amount usually matches your mortgage balance.

Why it matters:

✅ Keeps your family in the home

✅ Pays directly to the lender (or sometimes to your family)

✅ Often easier to qualify for than traditional life insurance

1450

HAPPY CLIENTS

12

INSURANCE PRODUCTS

14

YEARS OF EXPERIENCE

120

PROFESSIONAL AGENTS

(562) 208-0515

Phone Number

3585 Main St Suite 206, Riverside CA 92501

Location

E-mail Address

RWright Consulting Services

© Copyright | RWright Consulting Services 2025. All Rights Reserved.